Following the enactment of a new Banking Business Proclamation No. 1360/2025 (the “Banking Proclamation”), the National Bank of Ethiopia (the “NBE”) has released a draft directive providing the Requirements for Licensing and Renewal of Banking Business and Representative offices (the “Draft Directive”). The draft is set to repeal Directive No. SBB/56/2013.

While the Banking Proclamation provided general requirements for the licensing of domestic banks, foreign bank subsidiaries, foreign bank branches, and representative offices, details were left to be addressed in a directive. The Draft Directive proposes specific licensing requirements, including minimum paid-up capital, application procedures, documentation, and regulatory fees.

In this issue of our insight, we explore the key features of the Draft Directive with a focus on the entry requirements for foreign bank subsidiaries, foreign bank branches, and representative offices. For an analysis of the Banking Proclamation in general, visit our previous insight here.

Minimum Capital Requirement

The Draft Directive sets a minimum capital requirement for establishing a foreign bank subsidiary or a foreign branch at 5 billion Birr (~USD 40 million). While this requirement applies equally to domestic and foreign banks, newly established domestic banks benefit from a transitional period to meet the requirement. On the other hand, foreign subsidiaries and branches must remit the full amount into a blocked bank account.

The Draft Directive does not specify minimum capital requirements for foreign investors purchasing shares in domestic banks, nor does it address capital requirements for foreign nationals or foreign-owned Ethiopian organizations that can invest in domestic banks. It remains unclear whether these categories will be treated under the Investment Proclamation, which sets a USD 150,000 threshold for foreign investors participating in companies held by domestic investors.

Shareholding Limits

The Banking Proclamation provides that strategic foreign investors may acquire up to a maximum of 40% of existing or new domestic banks. In addition, a 49% aggregate cap is set for foreign ownership of domestic bank. The Draft Directive further breaks down the share ownership percentage of the different types of shareholders per the table below: These shareholding limits also apply for partial or full foreign ownership of a foreign bank subsidiary.

Licensing Procedure

The Draft Directive outlines a three-stage process for obtaining a banking license: the pre-application phase, the application phase, and the operational commencement phase.

- Pre-application Phase

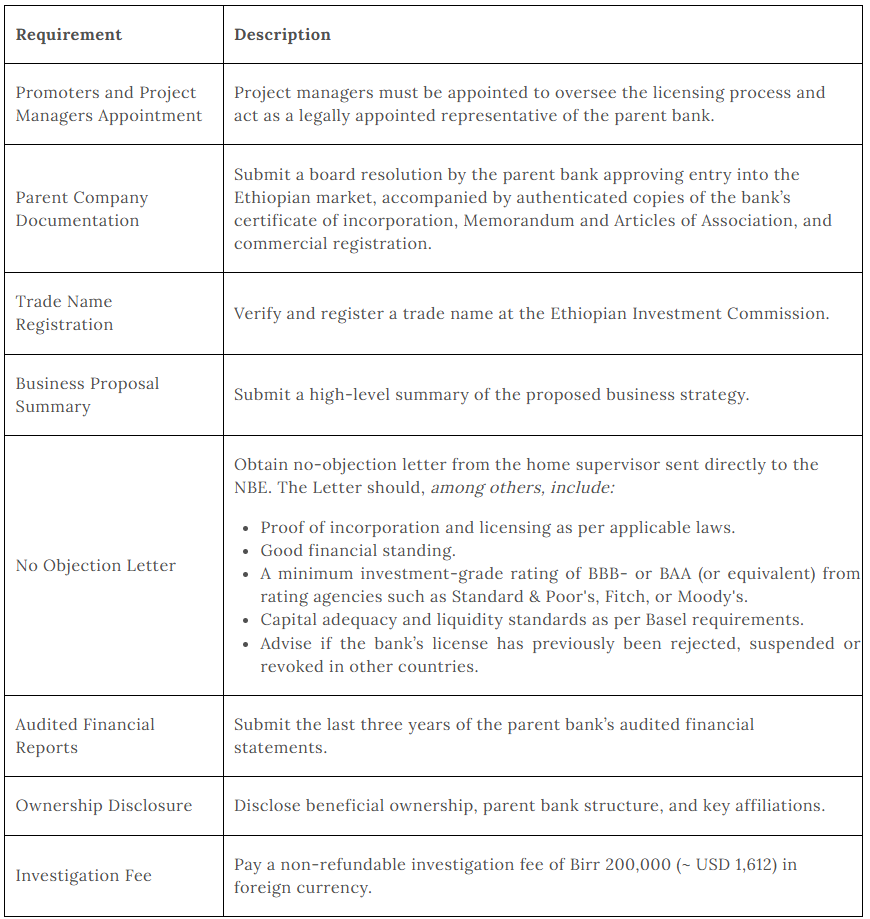

In this phase, the Draft Directive provides common documentation required for foreign bank applicants and more specific and additional requirements for foreign bank subsidiaries and foreign bank branches. Below is a summary of the required documentation and procedures for both subsidiaries and branches at the pre-application phase.

During this stage, the applicant must provide sufficient information to help NBE examine its business plan, assess preparedness, and offer feedback on potential concerns. The NBE may, at its discretion, hold a pre-application phase meeting with the promoters, project manager, and/or delegates of a foreign bank based on the high-level summary document to be prepared by the promoters and project managers. Once the NBE is satisfied with the pre-application phase, it will formally notify the applicant to proceed with the full application process. However, the Draft Directive does not provide a timeline on which the NBE will complete its per-application screening and inform the applicant of its decision.

The Draft Directive further provides for cases where promoters wish to raise capital through public offerings. In addition to the approval requirements under the Capital Markets Proclamation No. 1248/2021, promoters must meet all fit and propriety requirements the NBE undertakes. While the language under the Draft Directive does not distinguish between domestic or foreign banks raising capital through public offerings, it remains unclear whether a foreign bank subsidiary or branch, having fulfilled the initial minimum paid-up capital requirement, may subsequently raise additional capital through a public share offering.

- Application Phase

Once a pre-application is completed and the go-ahead is received from NBE, the following documentation must be submitted to NBE:

An MoU must be signed between the home regulator and NBE regarding information sharing and cooperation in regulating and supervising the foreign bank subsidiary. However, the Draft Directive is unclear on who facilitates the signing of the MoU, what the extent of the information sharing is or what form the cooperation would take. Additionally, the Draft Directive introduces a “supervisory college” that would be set up if the proposed foreign bank subsidiary is significant to the foreign bank. The Draft Directive neither defines nor provides details of what a supervisory college does and how it aligns with the supervisory role of the NBE.

The NBE, within 90 days of receiving all the necessary documentation from the applicant, decides on the application to either accept or reject. The rejection should clearly indicate the reasons behind it.

- Operation Phase

A licensed bank in Ethiopia must commence operations within 12 months of receiving its business license from the NBE. Further, it must comply with the following:

Licensing for Additional Branches

After opening the first branch, foreign banks may establish additional branches (deposit-taking or non-deposit-taking, but not both). These do not require additional capital or a full reassessment by NBE. However, each branch must obtain:

- A no-objection letter from the home supervisor,

- Payment of a non-refundable licensing fee in foreign currency (equivalent to the rate that applies to domestic branches, though the Draft Directive does not specify the domestic branch fee).

Notably, while the Banking Proclamation requires directives to address branch closures, the Draft Directive only covers opening procedures.

License Renewal

The Draft Directive provides that a license issued by NBE must be renewed annually between July 1 - September 30. Further, the banks are not required to go through any of the approval processes they did during the initial licensing. The Draft Directive details the supporting documents that must be presented with the renewal application upon the production of the original business license. The license renewal fee is set at Birr 400,000 (~USD 3,225) for foreign bank subsidiaries and foreign bank branches.

Foreign Bank Representative Office

The Banking Proclamation has shifted the regulatory mandate of supervising representative offices of foreign banks from the Ministry of Trade and Regional Integration to the NBE. Notably, the Draft Directive has introduced new and expansive rules on the licensing of representative offices. A foreign bank applying to open a representative office in Ethiopia must submit the following documentation to the NBE:

A foreign bank must renew its representative office license annually between July 1 and September 30. To apply, it must submit a renewal application, proof of a cash deposit of at least USD 100,000 for annual expenses, tax clearance from the Ethiopian Ministry of Revenue, the original license, and evidence of payment for the renewal fee (Birr 100,000 - ~USD 806) and any applicable penalties. Existing representative offices that previously acquired a license from the Ministry of Trade and Regional Integration are required to get relicensed by the NBE within 6 months of the directive becoming effective.

License Suspension and Revocation

Under the Banking Proclamation, NBE is authorized to suspend or revoke a banking license when a bank fails to meet key regulatory expectations.

A license may be revoked if a bank does not commence operations within twelve (12) months of being licensed or if it ceases operations for over thirty (30) consecutive days without approval. Revocation may also occur if a bank is found to be insolvent, unable to meet its obligations, or engages in unsafe or unsound practices that threaten financial stability. The process generally requires the NBE to notify the institution in writing, explaining the reasons for the intended action and allowing the bank a chance to respond or remedy the situation within a specified timeframe. However, in cases of urgency or where public interest is at stake, the NBE may revoke a license without prior notice. Once revoked, the bank must cease all operations immediately, and a liquidator is appointed to manage its closure. The decision is then published to inform the public and relevant stakeholders.

Conclusion

The Draft Directive establishes detailed procedures for establishing and ongoing operation of domestic and foreign banks. It introduces clear processes for licensing, capital requirements, operational expectations and license renewal conditions. However, some areas require further clarification. Notably, the Draft Directive is silent on the minimum capital requirements applicable to foreign investors acquiring shares in domestic banks—particularly where the investors are not establishing new banks but entering through equity participation. Similarly, capital requirements for foreign nationals and foreign-owned Ethiopian organizations buying shares of domestic banks are not provided. It is unclear whether such investments are to be governed under the investment laws or whether they will be subject to a separate directive. It is also expected that NBE will issue additional directives to cover matters indicated in the Banking Proclamation.

--

Read the original publication at Mekdes & Associates